Life Insurance in and around Ft Worth

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

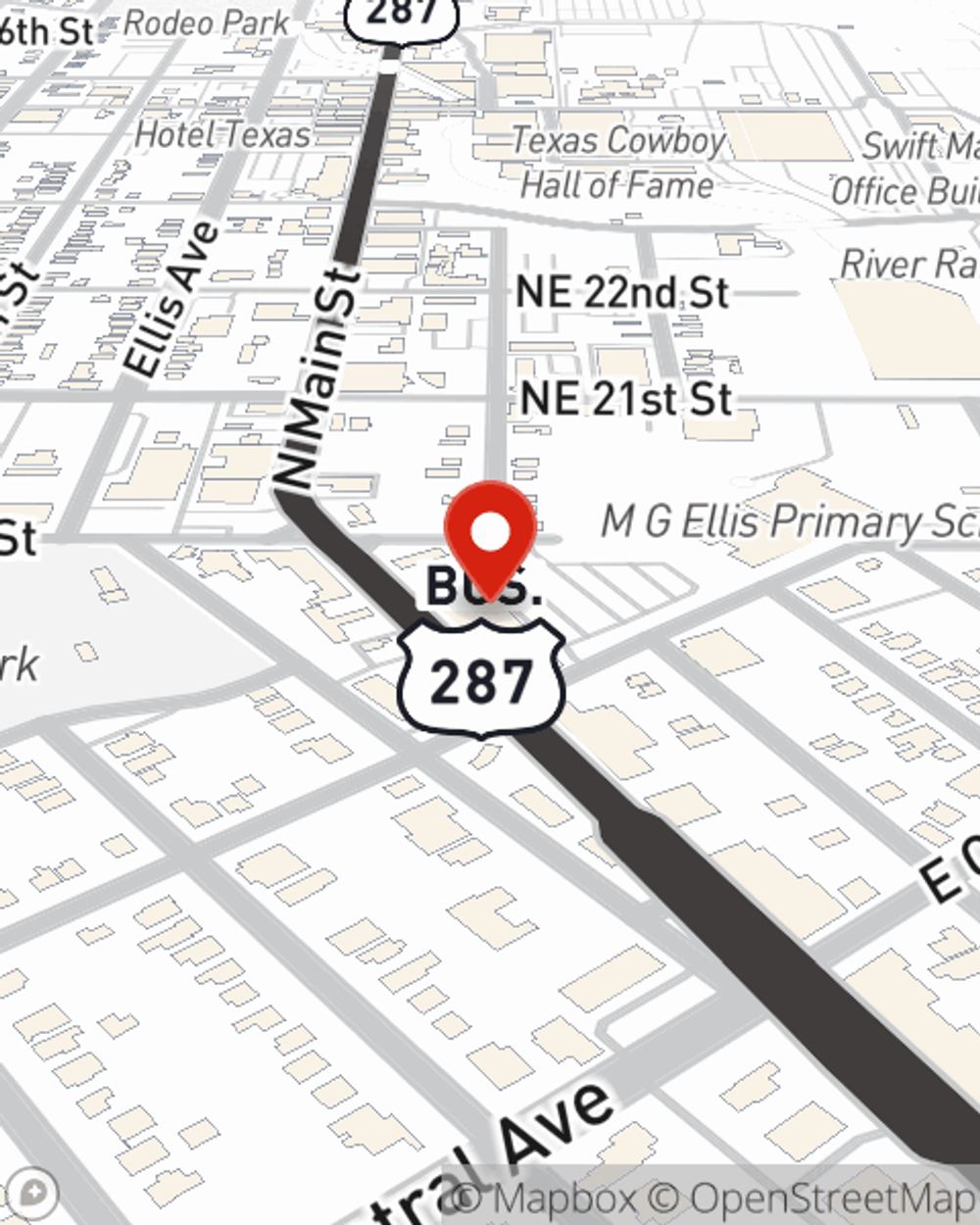

- Fort Worth

- River Oaks

- Lake Worth

- Haltom City

- Richland Hills

- North Richland Hills

- Haslet

- Saginaw

- Rhome

- Benbrook

- Crowley

- Roanoke

- Keller

- Watauga

- Eagle Mountain

- Burleson

- Cleburne

- Arlington

- Forest Hill

- Bedford

- Colleyville

- Euless

- Hurst

- Aledo

Protect Those You Love Most

It can be a big responsibility to take care of those closest to you, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your loved ones can pay off debts and/or keep paying for your home as they grieve your loss.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Put Those Worries To Rest

Fortunately, State Farm offers several coverage options that can be modified to align with the needs of your family members and their unique situation. Agent Michael Brewer has the deep commitment and service you're looking for to help you opt for coverage which can aid your loved ones in the wake of loss.

State Farm offers a great option for anyone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can prove useful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Michael Brewer, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Michael at (817) 625-7000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Michael Brewer

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.